Mortgage Loan Amortization

Businesses in the present environment aim at gaining more returns with the least operating cost possible. Most people dream of having homes of their own on one time of their lives. The moat challenging factor is shopping for a home at the most favorable rate.

Loan Amortization Rates

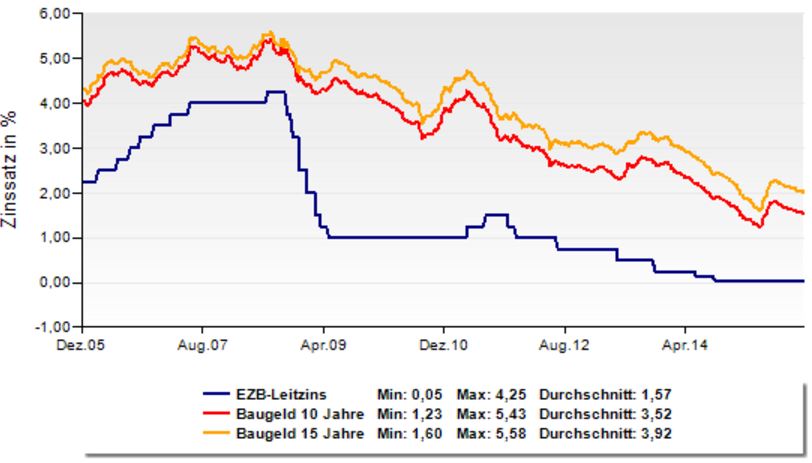

Changes in interest rates play a significant role in monthly payments made on a mortgage. In addition, the length of the loan offered in paying for a home affect the total amount of money repaid. In general, mortgage loan amortization is the process of calculating the monthly loan repayments in relation to the principal and towards the interest. The calculation involves loan amount, interest rate, and repayment start date. In the recent years, housing has been made stable in most areas due to the fact that real estate prices have stabilized. Most house owners experiences favorable loan amortization rates that fit their incomes.

Mortgage loan amortization benefits

- Mortgage loan amortization has benefited many people because it prevents them from being conned by fake house owners and middlemen.

- The introduction of online amortization calculator enables mortgage owners to determine the correct amount of money to refund each month depending on the agreed interest rate.

- The calculator gives the total amount of loan to be repaid at the end of the lease period bearing in mind the nature of interest rate changes due to changing economy.

Document needed when applying for mortgage loans

Two separate documents are used while applying for a mortgage loan. These are mortgage note and security interest evidence by the mortgage document. These two documents are given together and when split, either the loan bearer or the mortgage owner has the right to deny any contract made concerning a real estate. The Anglo-American law only accepts a mortgage transaction to have taken place only when the owner has pledged his or her interest as security for a mortgage.

Mortgage Market

The mortgage market can be broken down into two different entities: the primary mortgage and the secondary mortgage. The primary mortgage refers to the original mortgage market while the secondary mortgage refers to a place where the existing mortgage are purchased and sold. According to the mortgage history, the secondary mortgage has always been small and rarely active. Loan amortization ensures that a mortgage client has clear information on the amount of mortgage expected to pay at the end of the lease period depending on the contract interest rate (Berbanke 22-27).

Other useful links